According to a PwC global economic crime survey (2009), fraud has become a billion-dollar business that is increasing every year. That is, up to 30% of companies worldwide have been victims of fraud in the past years.

The traditional definition describes fraud as involving “one or more persons who intentionally act secretly to deprive another of something of value, for their own benefit.” In recent years, the development of new technologies has provided further ways in which criminals may commit fraud. Perhaps paradoxically, new information systems may present additional opportunities to commit fraud.

Our research team currently focuses on the following topics in fraud analytics:

- Novel machine learning techniques to detect fraud before it is committed

- Incorporating the social aspects of fraud using social network analysis

- Detecting organized fraudulent groups, i.e. web of fraud detection

From detection to prevention

We argue that fraud is not often something an individual would commit by himself, but it is a well-considered and carefully organized crime set up by groups of people loosely connected to each other. Although all analyses focus in the first place on fraud detection, the emphasis of our research shifts towards fraud prevention, i.e. detecting fraud before it is even committed. As fraud is a time-evolving phenomenon, the challenge is to keep ahead of new types of fraud and to adapt to changing environment and surrounding effects.

Hence, the use of networked data in fraud detection becomes increasingly important to uncover fraudulent patterns and to detect in real-time when certain processes show some characteristics of irregular activities.

The social aspect of fraud

In contrast to traditional predictive data mining techniques, the research domain of social network analysis focuses on the interrelationship between customers to obtain better insights in the propagation of e.g. marketing campaigns, customer churn and retention, and fraudulent behavior. Customers directly and indirectly influence one other. Lots of valuable data and information is hidden in the underlying network structure connecting customers to each other. Our research team is specialized in analyzing networked data for fraud detection.

In general, we aim to detect fraud on two levels:

- the individual fraudsters and;

- organized groups of fraudsters.

Individual fraud detection: Gotcha!

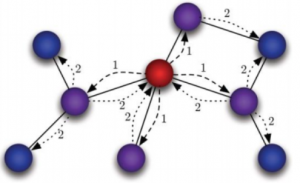

One of the applications developed for individual fraud detection is Gotcha!, a network-based detection approach that combines insights for traditional fraud detection models with network knowledge. The network is explored for irregularities and measures the extent to which each individual is exposed to fraudulent influences. While most detection approaches are static in nature, Gotcha! exploits dynamic graphs, weighing fraud and the strengths of relationships between individuals over time.

Detecting organized groups: Gotch’all!

Rather than focusing on individual fraud, many businesses are struggling with the detection of illegal setups of fraudsters. This is also known as a web of fraud. In credit card fraud, for example, it is often a group of fraudsters that is responsible for the theft and malicious use of credit cards. Our team has developed Gotch’all! in order to identify and curtail fraudulent setups using the network among individuals. Furthermore, within a group different roles can be assigned to each individual, positioning and prioritizing the fraudulent effect that each individual has in the group.

Rather than focusing on individual fraud, many businesses are struggling with the detection of illegal setups of fraudsters. This is also known as a web of fraud. In credit card fraud, for example, it is often a group of fraudsters that is responsible for the theft and malicious use of credit cards. Our team has developed Gotch’all! in order to identify and curtail fraudulent setups using the network among individuals. Furthermore, within a group different roles can be assigned to each individual, positioning and prioritizing the fraudulent effect that each individual has in the group.

Further Reading

Video

Selected Publications

- Van Vlasselaer, V., Akoglu, L., Eliassi-Rad, T., Snoeck, M., Baesens, B. (2015). Guilt-by-constellation: fraud detection by suspicious clique memberships. Proceedings of 48 Annual Hawaii International Conference on System Sciences: Vol. accepted. HICSS-48. Kauai (Hawaii), 5-8 January 2015.

- Van Vlasselaer, V., Akoglu, L., Eliassi-Rad, T., Snoeck, M., Baesens, B. (2014). Finding cliques in large fraudulent networks: theory and insights. Conference of the International Federation of Operational Research Societies (IFORS 2014). Barcelona (Spain), 13-18 July 2014.

- Van Vlasselaer, V., Akoglu, L., Eliassi-Rad, T., Snoeck, M., Baesens, B. (2014). Gotch’all! Advanced network analysis for detecting groups of fraud. PAW (Predictive Analytics World). London (UK), 29-30 October 2014.

- Van Vlasselaer, V., Van Dromme, D., Baesens, B. (2013). Social network analysis for detecting spider constructions in social security fraud: new insights and challenges: vol. accepted. European Conference on Operational Research. Rome (Italy), 1-4 July 2013.

- Van Vlasselaer, V., Meskens, J., Van Dromme, D., Baesens, B. (2013). Using social network knowledge for detecting spider constructions in social security fraud. Proceedings of the 2013 IEEE/ACM International Conference on Advances in Social Network Analysis and Mining. ASONAM. Niagara Falls (Canada), 25-28 August 2013 (pp. 813-820). 445 Hoes Lane, PO Box 1331, Piscataway, NJ 08855-1331, USA: IEEE Computer Society.